Bitcoin (BTC) dropped to new lows in February. 22 As the repercussions of the expected Russian incursion into Ukraine caused further market problems.

Gold comes to the rescue with Bitcoin volatility

information from Cointelegraph Markets Pro And the TradingView BTC/USD showed it reaching $36,400 on Bitstamp overnight Tuesday, its lowest level since February 3. 3.

Volatility was high as Russian President Vladimir Putin delivered an almost hour-long speech on the state of the conflict in Ukraine. Putin ended up recognizing the two breakaway republics in the east of the country, and later ordered Russian forces to enter what is still officially Ukrainian territory.

As a result, stocks and risky assets are down, with Russian companies expected to suffer as tensions mount over all-out war.

The Russian ruble fell side-by-side, breaking above 80 per dollar and breaching record lows of 85.6 from 2016. Sanctions from the West are expected later today, likely leading to further losses.

Gold was the surprise winner, as it managed to avoid losses to bolster its safe haven status – unlike Bitcoin.

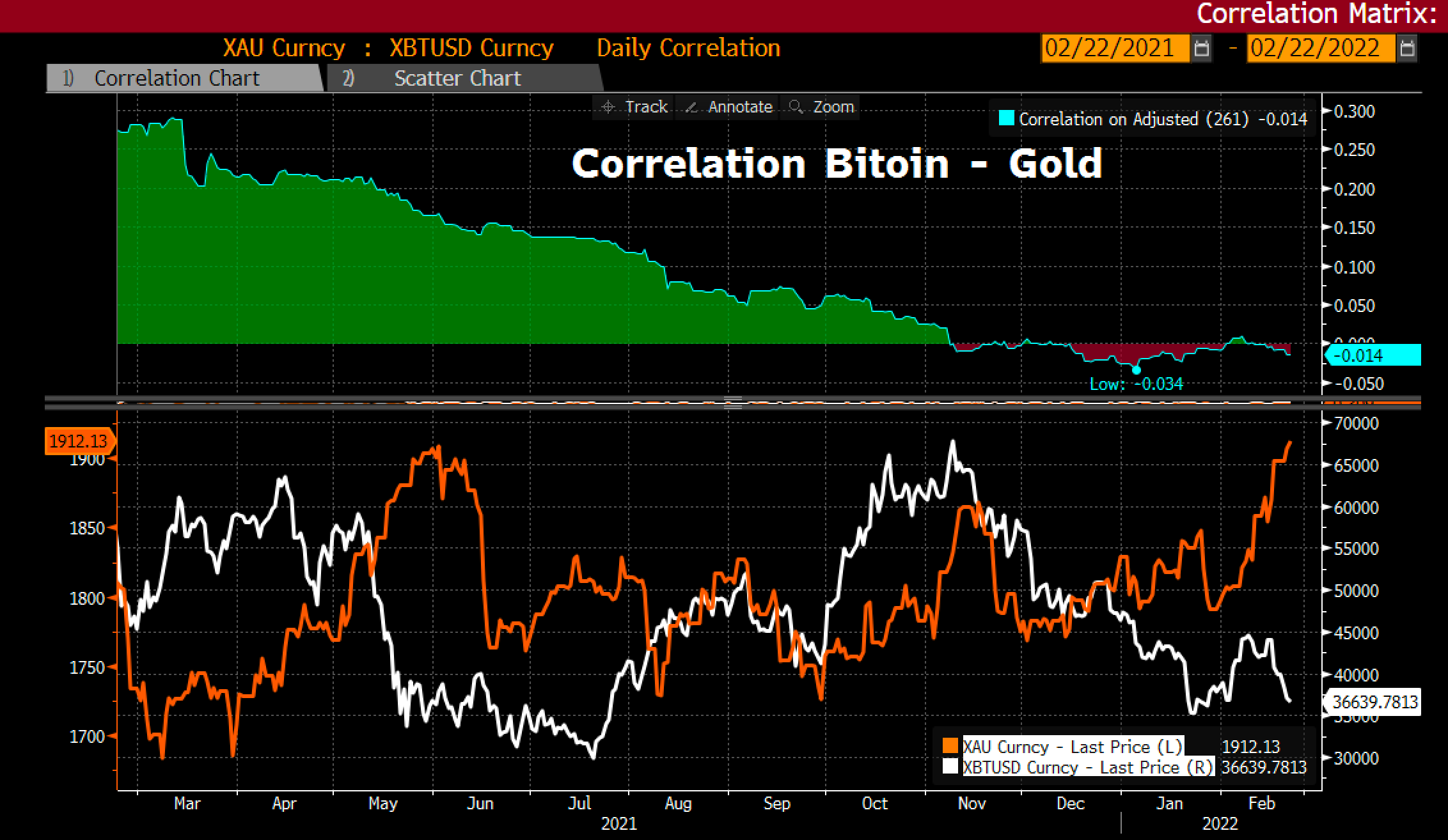

“It looks like bitcoin will not be a safe haven in the crises of geography,” said market commentator Holger Schaepitz. reaction.

“Digital gold (Bitcoin) dropped to $1,900/oz. The correlation between digital and analog gold is now negative. It has not been listed that digital gold is the best way to escape in Ukraine.”

YTD XAU/USD is up over 6% at the time of writing, while BTC/USD is down 23%.

“It’s really great to see that gold is doing really well in these times of extreme uncertainty, crawling up, while risky assets like stocks and bitcoin are having a hard time,” said Michael van de Poppe, a contributor. in Cointelegraph stabbed.

Zschaepitz added That investments in gold-backed exchange-traded funds, or ETFs, had been increasing throughout February.

A bearish cross of the series scale looms

And so Russia took center stage for bitcoin traders, who on Monday sadly watched Storm clouds also gathered over Asian markets.

Related: Are Coin Days Ruined by a Bottom Rally? 5 things to watch in Bitcoin this week

A rout in tech stocks on the back of a fresh regulatory crackdown from China sent a two-day drop in some of the biggest stock bets, including Tencent.

“$39.6K is now the new major resistance that the Bitcoin bulls must return to,” noted analyst Matthew Hyland. He said Tuesday.

he is added The 3-day moving average convergence/divergence is now poised to print a bearish cross, in direct contrast to previous hopes that an upward breakout might precede fresh BTC price strength.

Emotions have also been hurt by recent events, with Cryptographic Fear and Greed Index Down to 20/100 – in the “Extreme Fear” segment.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”