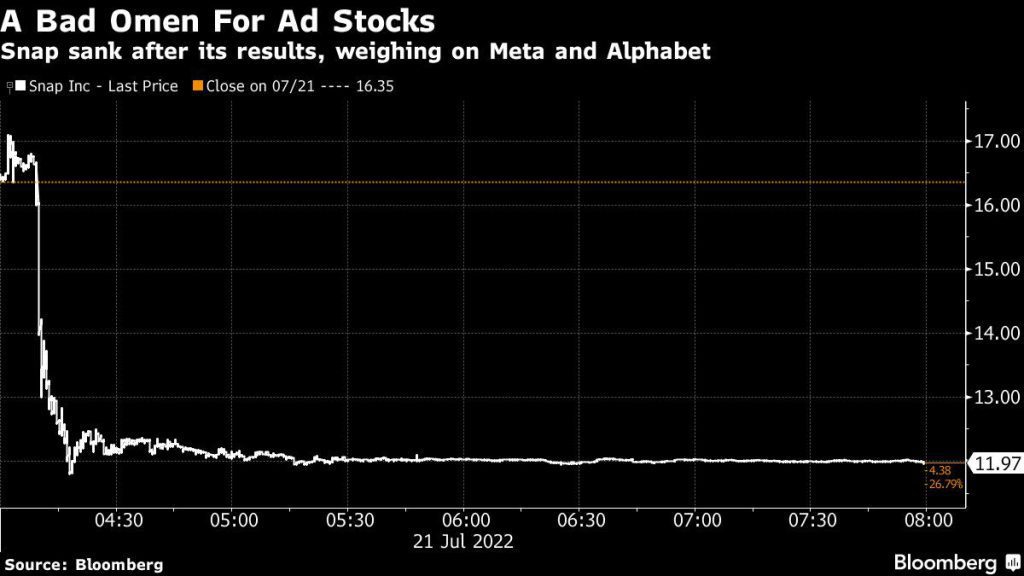

(Bloomberg) — US social media giants prepared to see more than $76 billion wiped from stock market values Friday after disappointing returns from Snap Inc. It raised concerns about the prospects for online advertising.

Most Read From Bloomberg

Shares of parent company Snapchat are down as much as 30% in pre-market trading. Meanwhile, Meta Platforms Inc. subsidiary of Facebook fell 4.8%, owner of Google Alphabet Inc. Down 2.8%, Twitter Inc. It fell 2.5% and Pinterest fell 7.2%.

The losses mark Snap’s second big selloff in two months, with its results becoming a barometer for investors trying to decipher the impact of economic uncertainty on ad spending. There are growing signs that tech companies are preparing for a recession with some pulling back on hiring, while Meta has lost about half its value this year after disappointing revenue forecasts.

Wall Street analysts were quick to respond, with at least nine brokerages slashing recommendations on Snap shares, while several others slashed their price targets. Shares are down 65% this year, but their average 12-month price target is down more than 72% in the same period.

“TikTok’s strong involvement and rapid monetization growth have a significant impact on Snap’s business,” JPMorgan analyst Doug Anmuth wrote in a note. He downgraded the stock to underweight and lowered his price target to a Wall Street low of $9.

Snap hasn’t released financial guidance for the third quarter, except to say revenue so far in the period is flat compared to a year ago. Management also reiterated that it plans to “significantly reduce the hiring rate,” echoing Apple Inc’s plans. and others.

“Earnings optimism may pause for now,” said Tina Teng, market analyst at CMC Markets in Auckland. “Snap’s failure in earnings forecasts points to the severe challenges that its tech peers face, typically on social platforms such as Meta Platforms.”

Vital Knowledge described the results from Snap and Seagate Technology Holdings Plc as “appalling” and “ugly”. Collapsing tech stocks could already face more pressure as earnings season picks up next week.

Read: Snap Growth Dimmed to 2023 in Uncertainty: Bloomberg Intelligence

“With more and more big tech companies planning to slow hiring and lower growth expectations, the economic outlook is definitely not in good shape,” said CMC’s Teng.

(Updates are shared all the time.)

Most Read From Bloomberg Businessweek

© Bloomberg LP 2022

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”

More Stories

Netflix reported strong subscriber gains but disappointing second-quarter revenue forecasts

US futures rise as technology rebounds, with Netflix earnings emerging

Google fires 28 employees after protesting Israeli cloud contract