The stock (stock symbol: AMC) rose 26% early Monday after a judge blocked AMC’s plan to convert so-called APE shares into common shares.

At one point in pre-market trading on Monday, the stock was up 70%.

Perhaps the volatility is not over yet. AMC has submitted a revised share transfer offer in an effort to address the court’s concerns. Chief executive Adam Aaron said that if the court is satisfied he hopes to move forward with the plan “as soon as possible”.

If that happens, expect the rest of the winnings since the ruling to be quickly reversed.

Announcement – scroll to continue

The ruling, delivered on Friday by Delaware Deputy Counsel Morgan Zorn, had a huge impact on stocks on a busy weekend for the movie theater group that premiered the Barbie and Oppenheimer movies. AMC stock (stock symbol: AMC) rose 26% Monday to $5.46, while APE shares (APE), or AMC Preferred Equity, fell 1.4% to $1.76.

Details of the amended settlement have not yet been disclosed, but the file is expected to be made available to the public on Monday, Bloomberg reported, citing people familiar with the matter.

Wedbush analysts, led by Alicia Reese, said they expect the volatility to continue as the judge considers adjustments made by AMC. They added that despite the rise in the stock, the ruling may lead to further dilution in the stock.

Announcement – scroll to continue

Shareholders who challenged the conversion argued that it diluted existing shareholders without compensation, which eventually led to a settlement.

“What may not be clear to AMC shareholders is that if the company is unable to convert APE shares, AMC will be forced to issue more APE shares to cover its upcoming cash requirements,” they said. They have an underperforming rating on AMC with a $2 price target.

For AMC, it’s about raising money and reducing its debt buildup, which escalated during the pandemic when movie theaters were closed. It’s even more urgent given that the current writers and cast cast doubt on movie releases next year and beyond.

Announcement – scroll to continue

The conversion would have allowed AMC to raise more capital by selling shares. Aaron told investors that raising fresh capital in the near term is “critical” for the company and that AMC is working to address the court’s concerns.

“AMC must be in a position to raise equity capital. I repeat, to protect AMC shareholder value in the long run, we must be able to raise equity capital. This is especially the case now with the additional uncertainty caused by writers and actors strikes, which could delay film releases currently scheduled for 2024 and 2025,” Aaron wrote.

AMC reached a settlement with a group of shareholders, who argued that the share conversion weakened the existing common shareholders without any compensation in return. Attorneys for the plaintiffs said the terms of the settlement meant that common shareholders would receive shares worth more than $100 million.

Announcement – scroll to continue

But Judge Zorn said she could not agree to the settlement because the deal came at the expense of the APE unitholders.

“The granting of more shares to common stockholders necessarily comes at the expense of preferred units; consideration of settlement is detrimental to preferred unitholders,” she wrote. According to The Wall Street Journal.

Eric Wold, Riley Analyst, maintains a Neutral rating on AMC stock, with a price target of $4.50. The wording of the ruling, he said, “cannot accept the settlement as submitted, and would likely ‘open the door’ for approval of an amended settlement.

Write to Callum Keown at [email protected]

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”

More Stories

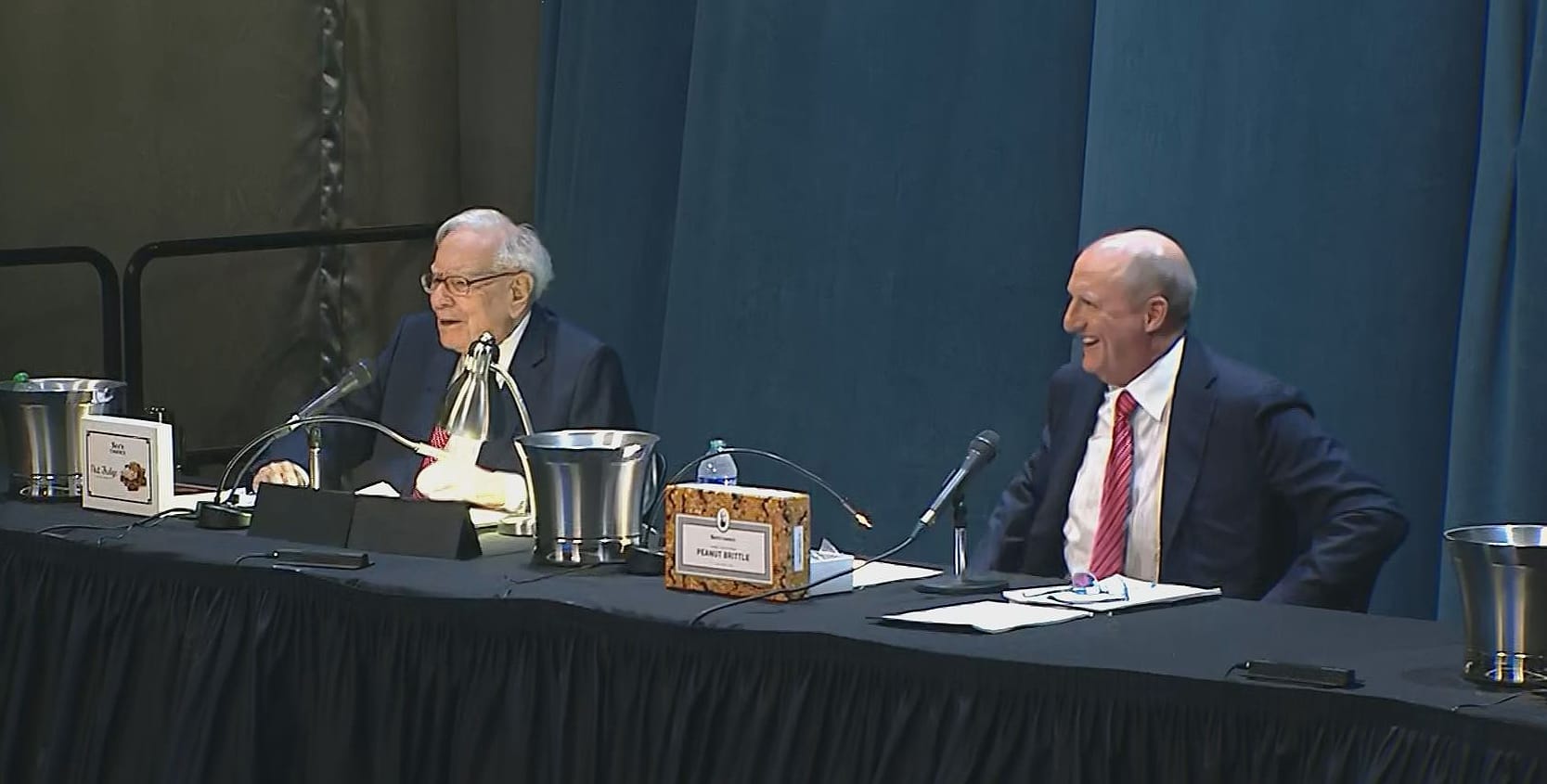

Warren Buffett says Greg Appel will make investment decisions at Berkshire Hathaway upon his departure

Berkshire Hathaway (BRK.A) Q1 2024 earnings

New audit firm hired by Trump Media busted by SEC for ‘massive fraud’