“Why the current tightening cycle is different from anything we have observed in the past.”

by Wolf Richter for Wolf Street.

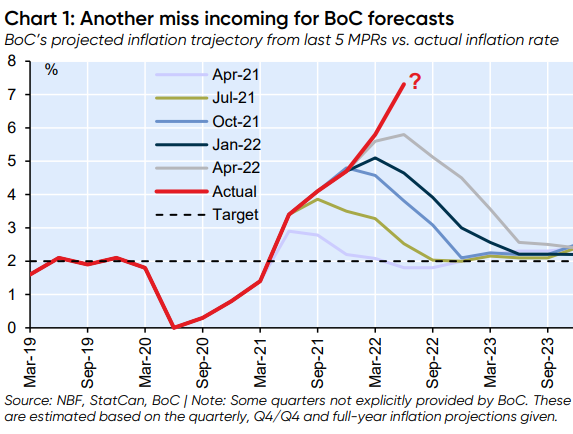

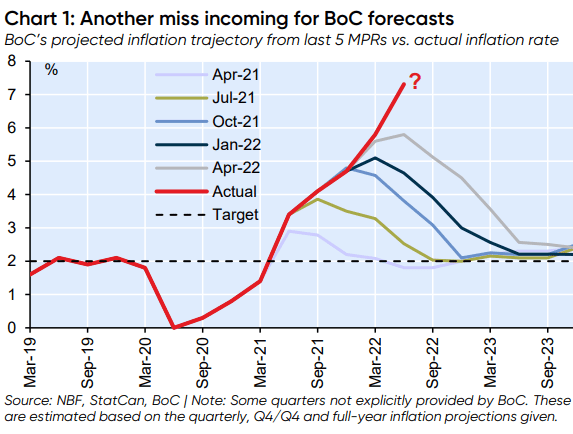

When the Canadian CPI for May was released two days ago, it was – “as expected”, I think – much worse than expected, and again by a large margin exceeded inflation expectations by the Bank of Canada. According to disgruntled economists at Canadian National Bank, CPI inflation is 1.5 percentage points higher than the Bank of Canada’s CPI forecast, topping those forecasts every step along the way. They wrote in a note that May was “the biggest mistake to date in systematically underestimating inflation”.

So, if the May CPI report doesn’t sound alarm bells in the boardroom [of the Bank of Canada]Someone should check their collective pulse.”

Canada’s headline CPI rose 7.7% in May from a year ago, the worst rate of inflation since 1983, according to Statistics Canada:

The Bank of Canada has already raised interest rates by 125 basis points to 1.50%. At its last meeting, it included hawkish language for larger and larger-than-expected rallies, such as a 75 basis point hike at the July meeting. The Bank of Canada also embarked on a QT, and its balance sheet had been shrinking since March 2021. But the rate hikes and hawkish language on future rate hikes were based on the Bank of Canada’s inflation forecasts which were a “systematic estimate of inflation”. So the rate-raising cycle is going to get interesting.

On a monthly basis, the CPI jumped an astonishing 1.4% in May compared to April, not seasonally adjusted. and at 1.1% seasonally adjusted. As expected, I would say, these rallies completely blew expectations.

Annual CPI rates for March, April and May increased to an annual rate of 12.5%.

The month-to-month hot increases came across the board, not just in a few commodity-related items. The Bank of Canada gave more than enough reason to pull the trigger at 75 basis points at its July 13th meeting.

“Inflation forecasts are not worth the paper they wrote on.”

Inflation forecasts released by the Bank of Canada at each of its previous meetings going back to April 2021 are depicted in different colors in the chart below from the National Bank of Canada’s Financial Markets Store. The red line is the actual CPI rate for each quarter. The Bank of Canada estimates at each meeting start with the current CPI rate.

So at its April 2021 meeting (in light blue, first line from the bottom), as inflation started to pick up, the Bank of Canada estimated that CPI would peak at just under 3% by mid-2021 and then drop to 2% by March 2022, ha ha ha.

Then at its July 2021 meeting, the Bank of Canada projected inflation would reach 3.8% by the third quarter of 2021, then drop to about 3% now, hahaha, and to 2% by the third quarter.

The graph above shows just how ridiculously ridiculous these inflation expectations are, and how this inflationary wildcard is getting worse, even as commodity prices start to fall.

“For Bank of Canada watchers trying to compare the trajectory of inflation today to previous periods of monetary tightening, give up. There is simply no comparison in the overnight target rate era (beginning in the mid-1990s). This is why the current tightening cycle is unlike anything we have observed. In the past,” Warren Lovely of the National Bank of Canada and Taylor Schleich said in their notes.

“Despite the aggressiveness of the BoC’s actions at the time, it was time to turn the screws more tightly,” they said.

“A 75 basis point rate hike on July 13th will not solve Canada’s inflation problem, not with labor markets tightening as they are. Vacancy data aside, job vacancy data is clearly worrisome, and Canada’s severe labor shortage will not be addressed quickly though from the resumption of healthy population growth. [through immigration]They wrote.

Sprinkled with a stark spirit of hypertrophy, they added:

To summarize: we have inflation that is out of control. Just sending more money to families like some governments have done (or intend to do) is just like adding gasoline (which itself is really expensive) to a fire.

Inflation requires a strong response from the Bank of Canada, including an increase of 75 basis points in three weeks.

“Extraordinary rate hikes have done little to control prices (so far) but have turned housing markets upside down. Consumers are being watched and recession risks are rising.

“Indeed, with inflation data like this, securing a ‘soft landing’ could be like the thread of the eye of a needle. We haven’t given up hope entirely, but today’s CPI report should awaken even the most enthusiastic among us.”

The Fed has also been ridiculously far from its inflation forecast every step of the way, and is now frustrated by its “temporary” and transitory use.” The ECB has also been ridiculously far removed from its inflation forecast. And their monetary policies – their refusal to raise interest rates from early 2021, their refusal to end quantitative easing and start QT at the same time – were driven by this absurd underestimation of inflation.But now they’ve got the memo.

It’s an interesting turn of events that economists at major banks in Canada and the United States and everywhere are urging their central banks to crack down on inflation by raising interest rates harder and harder as this inflation threatens to spiral out of control, and then the economic damage will be The financial result of hyperinflation is enormous.

The stock and bond markets have already responded sharply to this tightening scenario, and in Canada, the housing markets have already “turned upside down” and central banks are just beginning to tighten, nothing central banks have done in recent decades can compare to what comes next, if the recession Part of a deal to control this hyperinflation, so be it.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”

![[EN IMAGES] Two people were injured in an apartment building fire in Levis](https://m1.quebecormedia.com/emp/emp/5ecb18a0-03bf-11ef-aa27-cb5b29e68027_ORIGINAL.jpg?impolicy=crop-resize&x=252&y=0&w=948&h=533&width=1200)

More Stories

The Fed's main measure of inflation rose 2.8%

The Bank of Japan keeps its monetary policy unchanged

The Dow fell nearly 700 points as new inflation fears dampened hopes for a Fed rate cut.