Stock futures were muted in early trading Thursday, as traders digested a sharp rally from the previous session.

Stock futures related to the Dow Jones Industrial Average fell 27 points, or 0.1%, while futures for the S&P 500 and Nasdaq 100 were marginally lower.

micron technology Shares fell 3% in the premarket disappointing quarterly results. Under Armor shares Switched between winnings and losses after The sportswear manufacturer tapped Marriott executive Stephanie Lennarts as its new CEO.

The moves came after another positive session for stocks. On Wednesday, the Dow Jones rose 526.74 points, while the S&P 500 and Nasdaq Composite gained 1.49% and 1.54%, respectively.

All 11 S&P sectors ended the day with gains sending energy higher. Shares of Nike and FedEx rose on a quarterly basis, giving some investors hope that earnings are doing decently despite fears of a downturn. Strong consumer confidence data for December also gave the markets a boost.

While better earnings results likely factored into the upbeat market sentiment on Wednesday, oversold conditions may have contributed to the rally, according to Liz Ann Saunders, chief investment strategist at Charles Schwab.

“I think there were a couple of earnings reports that were marginally better than expected,” she said. “But I also think that the market is going through another corrective phase and, in some technical terms, has become a bit oversold. Buyers have stepped in. It’s hard to put a direct finger on the volatility on a daily basis.”

Even with Wednesday’s gains, stocks are on track to end the month with losses. The Dow Jones fell by 3.51%, while the S&P 500 and Nasdaq fell by 4.94% and 6.62%, respectively. The 3 major averages were determined to break a 3-year winning streak and They are recording their worst annual performance since 2008.

On Thursday, investors await the CarMax earnings results and unemployment claims data.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”

More Stories

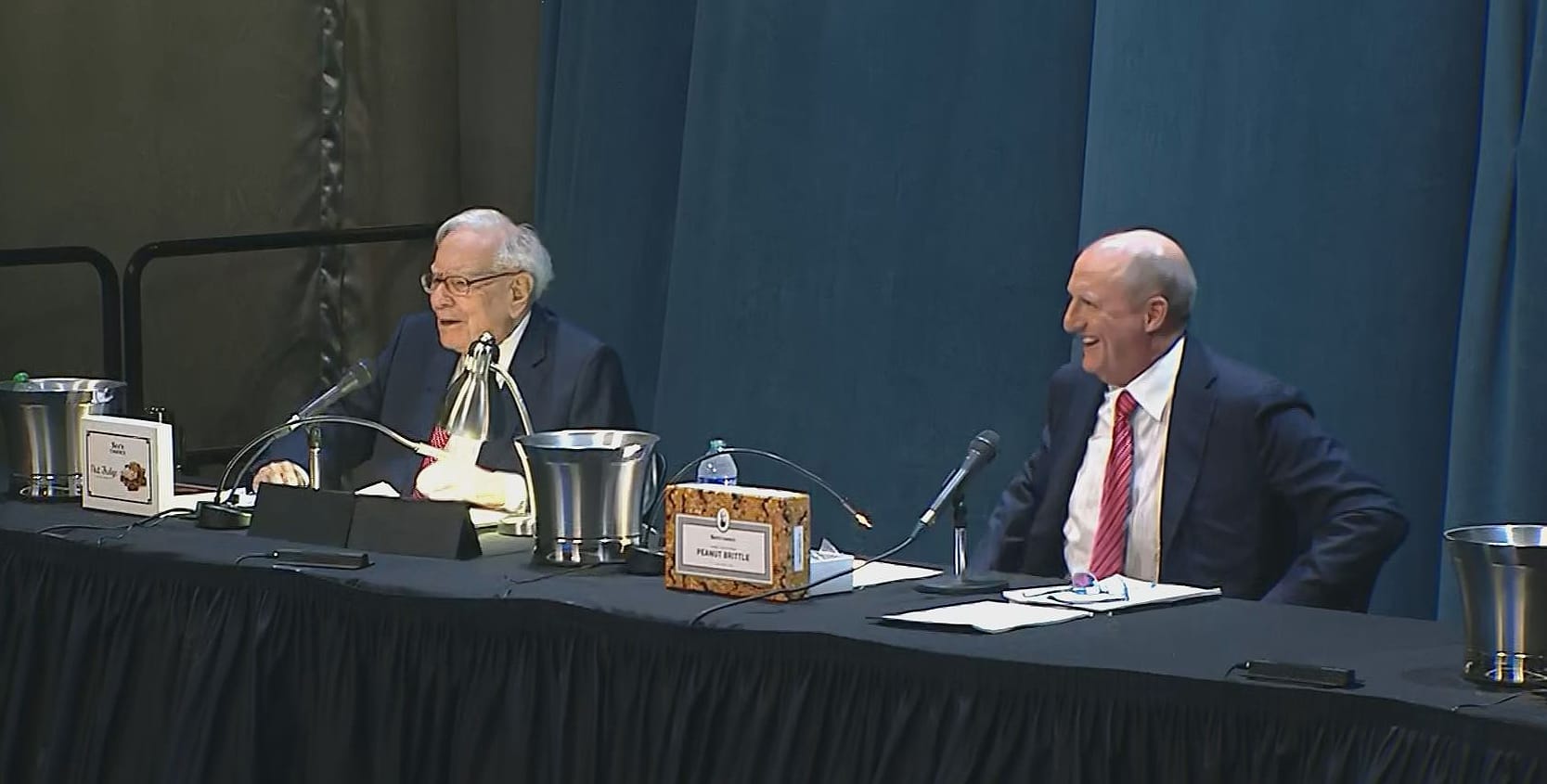

Warren Buffett says Greg Appel will make investment decisions at Berkshire Hathaway upon his departure

Berkshire Hathaway (BRK.A) Q1 2024 earnings

New audit firm hired by Trump Media busted by SEC for ‘massive fraud’