Tax car travel? Empty houses? Pavement parking lots? Montreal is considering new solutions to finance its next budget, according to a document made public Wednesday.

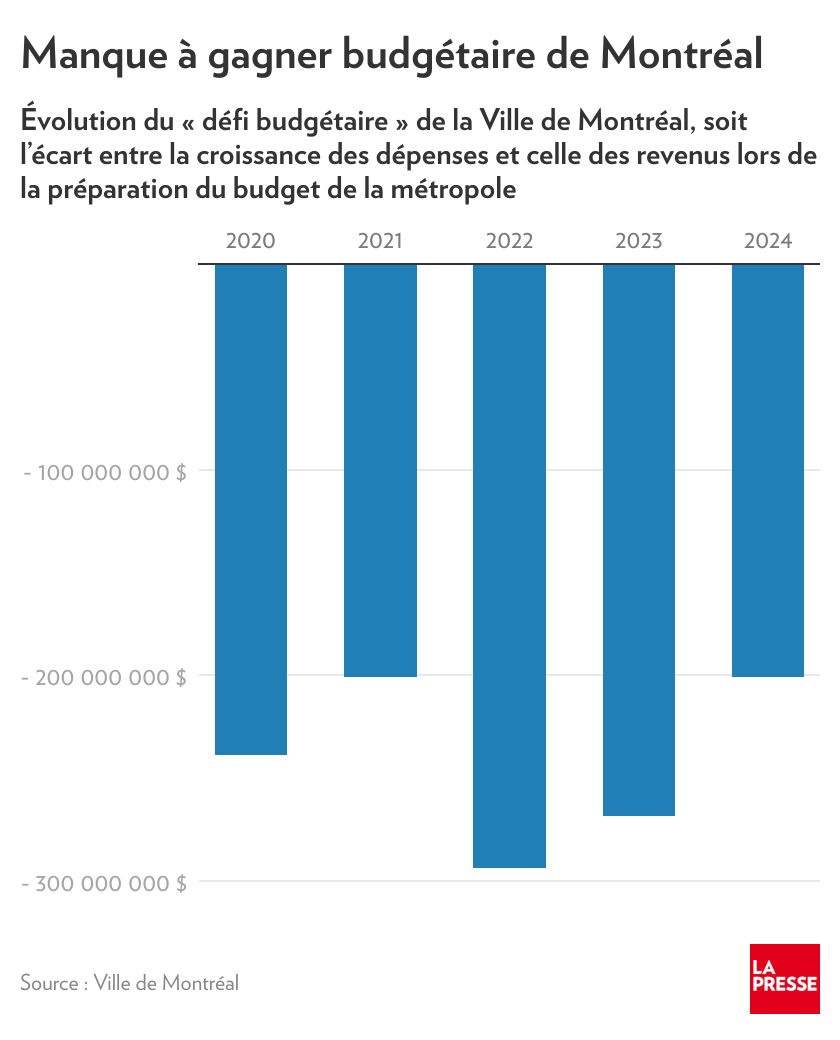

In addition to exploring the possibility of reducing the frequency of garbage collection or snow loading, the city is discussing eco-financial and social taxation measures. This should fill the currently expected 200 million gap between expenditure and revenue projections for 2024.

The ideas are being submitted to civil society for a consultation, which will open at the end of the month. “The aim is to find structural and sustainable solutions that allow Metropolis to adequately finance its activities and better meet the needs of the population,” notes Dominique Olivier, Chairman of the Management Board of Valérie Plante, in the introduction.

Property taxes, which represent the city’s main source of revenue, do not allow it to adequately meet its growing expenses and liabilities.

Dominique Olivier, Chairman of the Executive Committee

Here are some scenarios that the administration would like to hear from citizens:

- The current tax on petrol, which is being phased out by electric vehicles, is replaced by a tax for every kilometer behind the wheel of a vehicle.

- A tax on vacant housing plots to encourage landlords to lower rents to find takers. Vancouver, Toronto and Ottawa have all implemented some version of the measure in recent years.

- A levy on impervious surfaces – especially parking lots – that diverts rain and snow water to the municipal sewer system. “Environmental financing activity of this type, for example, would allow the financing of certain infrastructures to improve the management of running water. »

- Parking meters that change price on demand. A pilot program is already planned downtown this year, the document reveals: Hourly rates will increase from $4 to $5 on weekday afternoons.

- Royalties on the construction of new homes to finance the new municipal services needed to serve them. Currently, “all Montrealers have to bear these costs”.

The methods of these scenarios are not fixed and are part of the consultation. It is unknown whether the potential mileage tax would apply to all vehicles or whether the potential tax on impervious surfaces would only affect large parking lots.

On Wednesday, the plant management declined to comment further on the content of its consultation document.

“Truly in tune with the times”

Experts say Montreal is far from the only local government to turn to environmental taxation — taxing harmful behavior with the intention of discouraging it — to kill two birds with one stone, to protect the environment and bail out the chest.

“It’s really in tune with the times,” explained Justin Leroux, professor of economics at HEC Montreal.

It helps change behavior and generate revenue that can then be used to improve infrastructure or reduce taxes elsewhere.

Justin Leroux is Professor of Economics at HEC Montreal

In addition to environmental objectives (hence the name “ecology”), the concept can also be applied to taxes that discourage other behaviors, such as keeping a residence vacant, Leroux explained. “It’s really the idea of modifying a behavior through a price signal,” he said.

Jean-Philippe Meloch, a professor specializing in urban economics at the University of Montreal, believes Quebec is “socially behind” other societies in terms of environmental taxation: “We have a carbon tax, but it’s very weak. We have a fuel tax, but it’s very low. We have Environmental taxation has a very diluted application. »

However, according to him, local bodies such as municipalities should not be held accountable. Many of these measures – particularly the one kilometer line – cannot be used on a small scale.

Are services being reduced in sight?

In addition to introducing new tax deductions, the administration’s pre-budget consultation document also mentions possible reductions in spending by the city of Montreal.

“Does the City have measures that would require the City to review the level of certain services,” Montreal asks in the document.

“It’s going to be a question of frequency [de l’enlèvement des ordures], such as weekly or biweekly, the document continues. Also, today snow loading operations are carried out with 8 to 10 cm of snow. Better to ask if these standards can be reviewed to create savings without reducing the quality of services. »

Part of the response should include the possibility of shifting some responsibilities to devolved cities or directly asking other levels of government to accept certain services.

“Music geek. Coffee lover. Devoted food scholar. Web buff. Passionate internet guru.”